Today, TikTok is no longer just an entertainment app. It has evolved into a hybrid ecosystem that functions simultaneously as a content platform, a discovery engine, an e-commerce channel, and a brand incubation environment.

In this context, simply “being present” on TikTok is not enough. Success requires a clear understanding of how the algorithm works, how user behavior is shifting, and what performance data reveals about real advertising ROI.

Part 1: Massive Scale and Continued Growth

Understanding TikTok’s scale is essential to understanding its marketing potential. Current growth patterns indicate that the platform continues to absorb market share from traditional social networks.

1. Global reach: As of 2025, TikTok advertising can reach more than 1.59 billion users worldwide, making it one of the largest advertising platforms globally.

2. Audience penetration: This represents 19.4% of the global population aged 13 and above that can be reached through TikTok ads.

3. Download leadership: TikTok has ranked first among non-gaming apps by global downloads for multiple consecutive years, surpassing 4 billion lifetime installs.

4. U.S. market scale: Monthly active users in the United States exceed 170 million, meaning more than half of the U.S. population uses TikTok.

5. Revenue milestone: TikTok became the first non-gaming app to generate over 1 billion USD in consumer spending within a single quarter.

6. Website traffic: TikTok.com has ranked among the most visited domains globally and has, at times, surpassed Google.com.

7. Language and market coverage: TikTok supports 75 languages and operates in more than 150 markets.

8. Device distribution: Approximately 70% of TikTok’s global user base accesses the platform via Android devices.

9. Corporate valuation: ByteDance remains one of the world’s highest-valued private companies, with TikTok accounting for a significant share of its valuation.

10. Daily active users: Global daily active users have stabilized at over 1 billion.

Part 2: Highly Engaged User Behavior

For marketers, the critical question is not only how many users TikTok has, but how deeply those users engage. TikTok’s core advantage lies in its immersive, high-attention experience.

11. Time spent: Average global daily usage exceeds 90 minutes per user, outperforming Instagram and YouTube Shorts.

12. App open frequency: Active users open TikTok an average of 19 times per day.

13. Sound-on viewing: Approximately 90% of users watch TikTok videos with sound enabled, making audio a key branding element.

14. Full-screen experience: TikTok is the only major social platform where users spend all viewing time in full-screen mode.

15. Content creation: More than 50% of users upload content in addition to consuming it.

16. Search behavior: Nearly 40% of Gen Z users prefer TikTok over traditional search engines for information discovery.

17. News consumption: Thirty percent of adults report consuming news content via TikTok, double the share seen in 2020.

18. Comment engagement: TikTok videos generate two to three times more comment interaction than Instagram content.

19. Content lifespan: Viral videos on TikTok typically remain active for 7 to 14 days, longer than on most other platforms.

20. Session duration: The average session length is approximately 10.85 minutes, among the longest in social media.

Part 3: Evolving Demographics

While TikTok is often perceived as a Gen Z platform, its user base is becoming older, more affluent, and more diverse.

21. Gen Z concentration: Users aged 10 to 24 account for approximately 40% of the audience, although this share is gradually declining.

22. Growth among older users: The proportion of users aged 45 to 54 has increased from 7.9% to 9.2%, bringing stronger purchasing power.

23. Senior adoption: Users aged 55 and above now represent 8.4% of the platform’s audience.

24. Gender distribution: Globally, TikTok’s audience is approximately 57% female and 43% male, with regional variations.

25. High-income households: In the United States, users from households earning over 100,000 USD annually are among the fastest-growing segments.

26. Regional expansion: Southeast Asia remains one of TikTok’s fastest-growing regions, with more than 270 million users.

27. Education level: Approximately 30% of U.S. adult users hold a college degree or higher.

28. Family usage patterns: Parent and teen co-usage is increasing following the rollout of family safety features.

29. Urban and rural reach: TikTok penetration in non-tier-one cities is notably higher than that of many competing platforms.

30. B2B audience growth: Professional and career-related content on TikTok now reaches tens of millions of users.

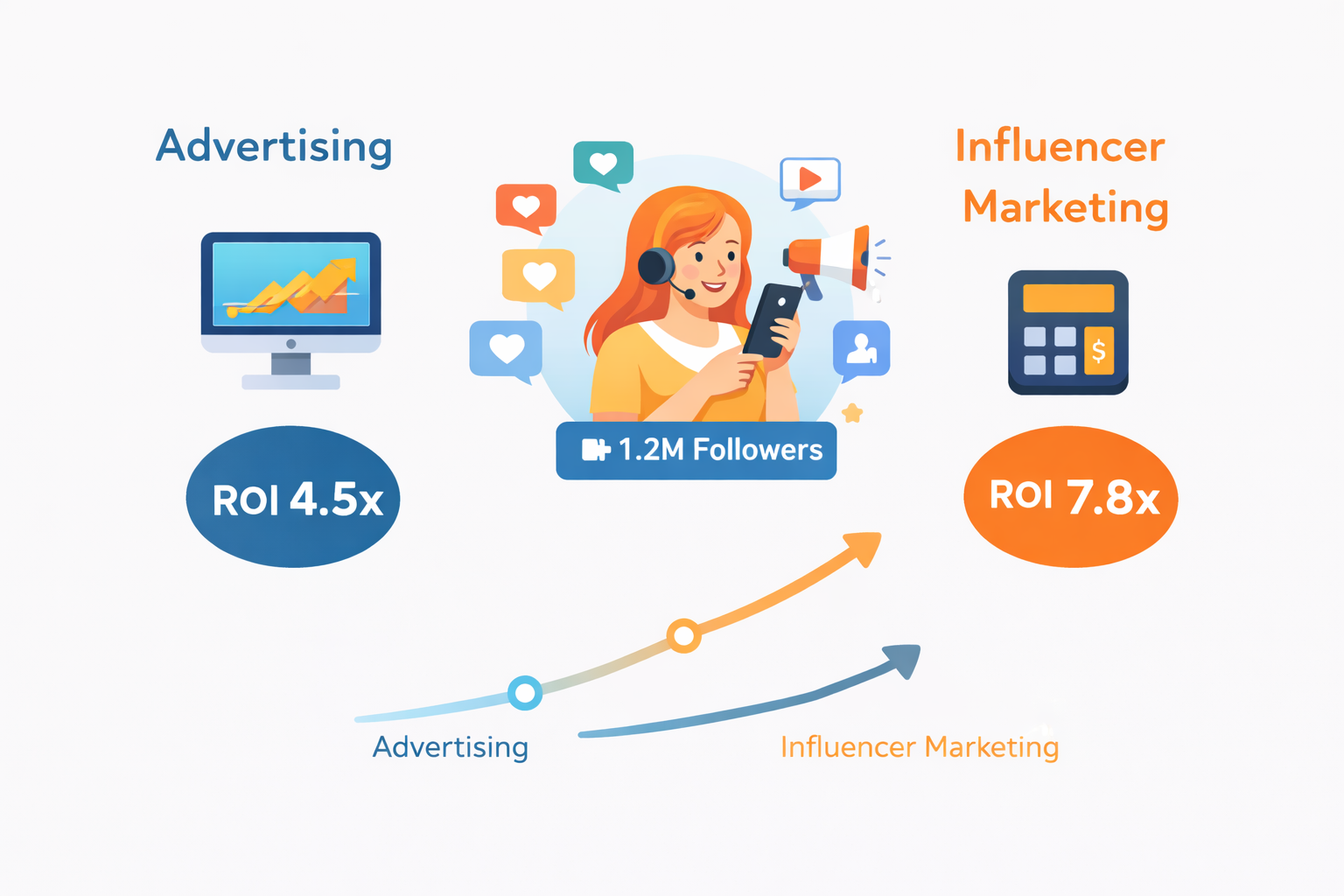

Part 4: Advertising Performance and Influencer ROI

Advertising performance remains the primary concern for marketers evaluating TikTok investment.

31. Nano-influencer performance: Creators with 1,000 to 10,000 followers achieve the highest average engagement rate at 11.9%.

32. Micro-influencer effectiveness: Creators with 10,000 to 50,000 followers average a 10.2% engagement rate, significantly outperforming larger accounts.

33. Ad perception: Seventy-two percent of users believe TikTok ads feel more native and creative than ads on other platforms.

34. Traffic campaign results: In-app traffic campaigns frequently achieve click-through rates above 6 to 7%.

35. Brand discovery: Fifty-five percent of users use TikTok to research new brands or products.

36. Purchase impact: Users are approximately 2.5 times more likely to make an immediate purchase after seeing a TikTok ad.

37. UGC effectiveness: Creator-led UGC-style ads improve ad recall by 27% compared with polished brand-led videos.

38. Hashtag challenges: Branded Hashtag Challenges generate an average engagement rate of 17.5%.

39. TopView performance: TopView ads significantly increase brand favorability, with lift rates reaching 71%.

40. Music-driven recall: Sixty-eight percent of users report stronger brand recall when ads use music they like.

Part 5: TikTok Shop and Social Commerce Trends

41. Impulse purchasing: Sixty-seven percent of users report making unplanned purchases influenced by TikTok content.

42. Cultural impact: The hashtag #TikTokMadeMeBuyIt has accumulated more than 80 billion views.

43. Live commerce conversion: TikTok Live Shopping conversion rates are more than three times higher than those of traditional e-commerce websites.

44. Product categories: Forty-nine percent of users have purchased tech products or small electronics through TikTok.

45. Top verticals: Beauty and fashion together account for more than 40% of TikTok Shop sales.

46. In-app spending behavior: Creator tipping and gifting have normalized in-app payment behavior.

47. Small business impact: Eighty-eight percent of small businesses on TikTok report direct sales growth driven by the platform.

48. Return rates: Products purchased via live streams show slightly lower return rates than those bought through traditional e-commerce channels.

49. Search-driven purchases: Users increasingly search for “best [product]” directly on TikTok and complete purchases within the app.

50. Market outlook: By 2026, TikTok is projected to surpass Facebook in U.S. social commerce market share.

What These Numbers Mean for Marketers

From these 50 data points, three strategic conclusions stand out for 2026.

First, data on influencers and UGC content shows that low-budget, creator-led videos consistently deliver stronger engagement and recall than high-production brand campaigns.

Second, TikTok has become a key search and discovery channel. With a significant share of Gen Z using TikTok as a search tool, brands must optimize captions, subtitles, and hashtags to capture intent-driven traffic.

Third, full-funnel marketing is now achievable within a single platform. TikTok supports awareness, consideration, and conversion in one continuous user journey, especially through TikTok Shop and live commerce.

TikTok’s statistics reveal a fast-moving and continuously evolving ecosystem. For brands, the question is no longer whether to participate, but how quickly they can adapt. Today’s TikTok resembles Facebook in 2010 or Google Ads in 2005. The opportunity remains significant, but competition is intensifying.

NewsBreak Platform Overview: America’s Local News Feed Gateway

January. 14 2026

LEARN MORE

Snapchat: A Camera-First Platform Powering Authentic Digital Connection

January. 14 2026

LEARN MORE

BIGO Ads Q4 2025 Performance Recap

December. 18 2025

LEARN MORE

Q4 U.S. LeadGen: Top Performing Verticals & Best‑Practice

December. 17 2025

LEARN MORE